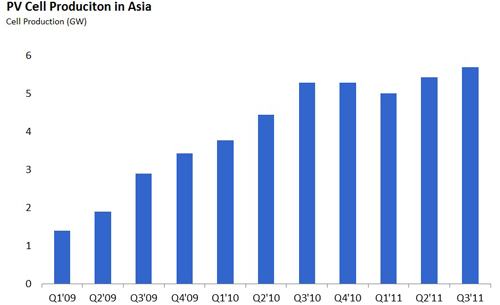

Wellingborough, UK – 17th February 2011 – Asian electronics giants such as Samsung and LG continue to enter the growing PV market, transferring their expertise in other cost-driven fields and are aiming to capture a major share of the market and IMS Research predicts that Asia’s share of PV cell production will reach nearly 85% by the end of 2011. Although the market is currently rife with fears of a module oversupply, these large Taiwanese and Korean electronics suppliers, such as Samsung, LG, AUO and Taiwan Semiconductor have all recently announced impressive expansion plans for their solar business segments.

IMS Research predicts that following the rapid PV cell and module capacity increases in 2010 when demand boomed in major European markets, lower incentive rates and the slowing of installation growth, will lead to an oversupply of PV modules in 2011. In particular, small Tier 2 suppliers are predicted to be most affected, with larger Tier 1 suppliers still able to sell the majority of their products.

However, the long-term outlook remains positive and IMS Research forecasts that total industry demand will continue to grow at double-digit rates on average for the next 4 years. As a result, a continuous stream of hopeful new entrants exists, and IMS Research predicts that the most successful of these are likely to be these consumer electronics manufacturers joining the pack. AUO Optronics, a Taiwanese supplier most known for its flat-panel displays recently broke ground on a 1.4 GW cell production Joint Venture with SunPower; Whilst LCD TV giant, Samsung recently announced a joint-venture producing polysilicon with MEMC, further expanding its activities in the solar industry, and although not a consumer electronics company, Taiwan Semiconductor also plans to begin offering both thin film and crystalline modules before long following its investments and partnerships with Motech, Stion and Centrosolar,

“The expertise of these large Asian suppliers at large-scale production in similar fields and their willingness and ability to invest significant capital is likely to mean that they are able to quickly reach low-cost and high-volume production, and they certainly have the potential to be serious competition for today’s market leaders within a few years,” commented PV Research Analyst Sam Wilkinson. “Many suppliers are currently experiencing a lull in shipments, and it is likely that demand may remain weak until later in the year.” “The entrance of a number of large electronics suppliers which will offer competitively-priced PV components is likely to add some further obstacles for existing suppliers in an already volatile market,” added Wilkinson.

IMS Research estimates that nearly 80% of PV modules were produced in Asia in 2010 and predicts this figure will continue to rise in the future.

- 第九届中国(无锡)国际新能源大会

-

本届新能源大会以“新城镇、新能源、新生活”为主题,举办2017全球新能源产业峰会及“光伏+”跨界、绿色建筑、分布式市场营销等10场专业论坛,国家能源局新能源和可再生能源司...

本届新能源大会以“新城镇、新能源、新生活”为主题,举办2017全球新能源产业峰会及“光伏+”跨界、绿色建筑、分布式市场营销等10场专业论坛,国家能源局新能源和可再生能源司...